By Tokiso TKay Nthebe

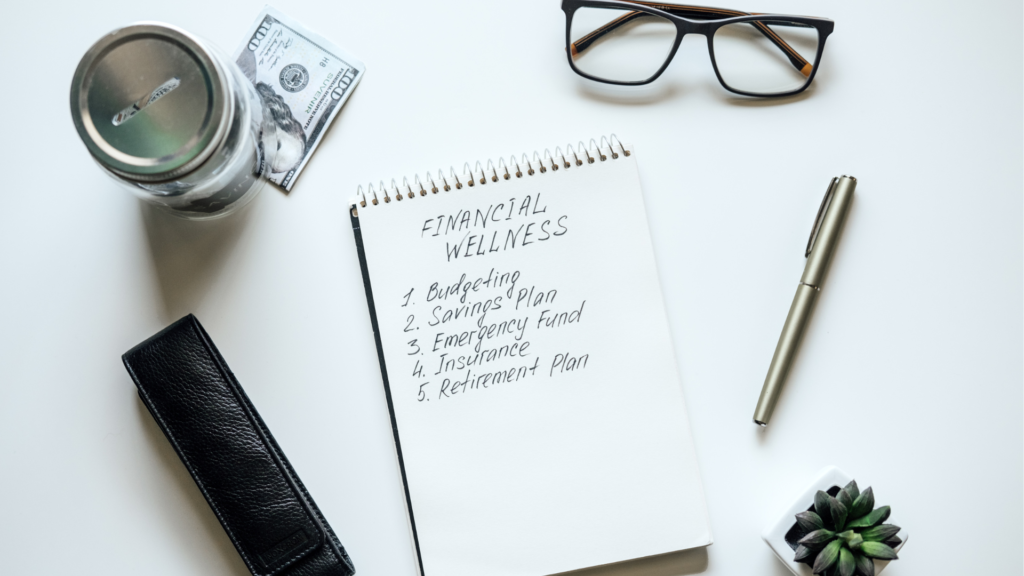

I am a BIG advocate for financial wellness, where I encourage people to have a solid and positive relationship with money, set realistic financial goals and plan for the future. Being financially healthy gives one a sense of security and peace of mind, especially when life happens and things spiral out of control i.e. accident, loss, childbirth, medical emergency, marriage, divorce or COVID-19. If you are not financially prepared or have a safety net, this can throw you off!

I have worked with many clients over the years and have come to appreciate that advocating for financial wellness in isolation is not enough. From a holistic wellness and financial planning perspective, the other seven pillars of holistic wellness which include the physical, spiritual, nutrition, social, emotional, intellectual and environmental are important considerations as they too influence our finances, whether positively or negatively.

As a personal finance coach, my biggest struggle in previous years was obsessively planning for tomorrow, where I aggressively saved and invested a huge percentage of my money because of the uncertainty of what may happen tomorrow. While so doing, I neglected the other pillars of wellness and accidentally sacrificed my overall wellbeing. I am the first to admit that planning for tomorrow is absolutely necessary. The danger for me however, was not allocating enough money towards the things that make me happy. I had pushed myself into a very uncomfortable position where I was saving so aggressively that I completely denied myself the opportunity to enjoy life today. I had absolutely no balance which resulted in resentment, bitterness and dare I say lack of fulfilment.

So how do we find a balance while managing our money?

As many of our trailblazer community start working on their new year’s goals and financial plans to achieve them, I would like to challenge you to consider doing the following:

- Align your financial goals with your life goals: If your goal is to grow spiritually, work on your personal development, invest in your relationships with family and friends, travel more and achieve your fitness goals, I encourage you to have a holistic approach and determine how much money each of these will need, align, and plan accordingly. This will bring so much meaning and balance as you set out to win and achieve your goals.

- Pay yourself first: Make it a habit to “pay yourself first” by putting away at least 20% of your income into a savings and investment accounts. It is important to save consistently, start where you are but do so without forgetting to live – going out with family and friends or doing the things that bring you the most joy. There is science behind the recommended 20%!

- Have a comprehensive financial plan: Financial planning remains a foreign concept for many young professionals. My challenge to you as you plan for the new year is to consult a qualified and registered financial planner or financial advisor to help you develop a financial plan, with a long-term view e.g. 3-7 years (still aligned to your life goals) in mind, with regular reviews. The reality is that life happens (death, childbirth, marriage, or illness), but you’ll be better prepared to weather the financial storm when you have a financial plan that caters for your short term and long-term financial needs.

- Have fun and live: Money is tool or resource that affords access to our desired lifestyle. It is our responsibility to manage it well, use it responsibly, enjoy and find a balance between living for today, but planning for tomorrow.

Financial prosperity is our birth right. Our responsibility, however, is to change our bad money habits, plan and be responsible with money!

I always say that “financial prosperity is our birth right. Our responsibility, however, is to change our bad money habits, plan and be responsible – while maintaining the BALANCE!”